Caravan Finance Comparison Calculator

Quickly assess, plan, and compare RV loans with our easy-to-use finance calculator. Get instant estimates for your RV loan repayments today!

Use Our Caravan Loan Calculator to Seamlessly Compare Rates - Find the Best Deal for Your Financial Situation

When sourcing a caravan loan, it’s easy to be overwhelmed by the extensive range of interest rates being offered by lenders, banks, finance companies and vehicle dealerships. By leveraging our handy online calculation tool, you can compare each of these rates easily to find a monthly repayment estimate that is going to work for you.

Seeking a caravan for personal use? Calculate repayments for Secured and Unsecured caravan loan credit facilities with our RV loan calculator. Pursuing a caravan for business use? Calculate repayments for Chattel Mortgage, Leasing, Rent-to-Own, and Commercial Hire Purchase using our RV loan calculator.

When using our online estimation device, keep in mind that individual rate offers are based on a lender’s assessment of your individual application. We recommend using our advertised current rates as a starting point when conducting estimations. Not only does this give you a great starting point, but you can also see how we stack up compared to our competitors!

Simply enter your details into the calculator and get your monthly repayment comparison within seconds.

As specialists in commercial and recreational caravan lending, our main goal is to achieve the best possible interest rates for each of our customers. Our huge list of 80+ banks and lenders we are accredited with means we have a multitudinous amount of loan options available to us. Let us find your ideal lender and the best loan terms for you.

Our calculator can be used to compare our competitive interest rates with others. Once you’re happy with your repayment estimate, give us a call or connect with us online for a fast quote tailored to your specific financial situation.

- Easily convert interest rates into loan repayments.

- Compare rates for Secured and Unsecured caravan loans.

- Find the best rates for commercial credit facilities for business RV finance.

Read more...

Thinking about buying a caravan on credit but unsure where to start?

Feeling overwhelmed by the many options available in the caravan lending market?

Want to compare different loan types and interest rates?

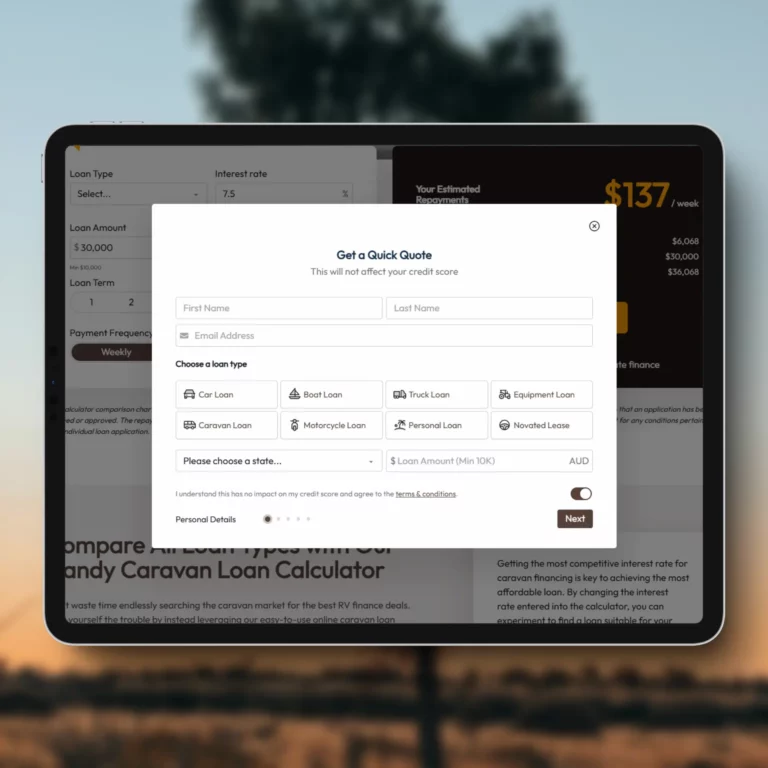

At Easy Caravan Finance, we offer a fast, simple and user-friendly way to get clear answers on caravan financing. Our online calculator is completely free – don’t stress about downloading any extra applications or succumbing to extra fees, just input a few details into the required fields and our tool will do the rest. Get quick repayment estimates to compare your caravan loan options, gain insights, and plan your loan application with confidence.

At Easy Caravan Finance, we have you covered! Enter your details now and get your first estimate in seconds!

Our Calculator, Your RV Finance Guide - Unlock Valuable Insights Today!

Knowing what your monthly financial commitment will be for a new or used caravan is invaluable information. It only takes a few seconds and can give you a sense of the price range you should be looking at. Make sure your loan payments match what you can comfortably afford by using our online RV loan calculator.

Just enter the vehicle price, our advertised rate for your selected loan type, and your preferred repayment term into the relevant fields. You’ll instantly be provided with the monthly payment amount for that combination. If you are making a deposit, make sure you subtract that amount from the purchase price prior to entering the loan amount.

Our calculator can be used as many times as you like for as many caravans as you’re considering. Save time by pinpointing the right price range for your financial situation from the start, then reach out to us for an accurate quote and to start the application process.

Easily estimate your loan repayments for all makes and models of caravan, new or used. Whether you’re in the market for a traditional caravan, camper trailer, campervan, toy hauler, motorhome, off-road vehicle, expedition rig, hybrid, budget friendly model, or custom-built van – our expert team of brokers have you covered.

Our full portfolio of loan products are available across all types of caravan so you can compare with ease. This means you can compare a camper with a caravan, a fully off-road vehicle with a hybrid, or an entry-level model with a top-of-the-line version.

With our highly competitive interest rates, you’ll be surprised at just how affordable your dream caravan could be. Enter your ideal figures in the calculator as a starting point and find a workable solution today!

When selecting a loan, you must carefully consider the term. That is, the length of time (in months or years) it will take you to repay it. Generally, a loan term will come down to your own personal preference, however, the lender will also need to approve it.

Determine whether a shorter, medium or longer term loan will work best for you and calculate repayment estimates based on that. To experiment with different loan terms and see how they affect your monthly payments, keep the loan amount and interest rate the same while solely adjusting the term.

Work out the loan structure that fits your financial goals and feel confident when applying.

When you use our caravan loan calculator, you have complete control over the figures you enter. This means you can experiment with as many different loan amounts and terms as you like to explore all your potential options. Such flexibility is very useful when figuring out how much you may want to deposit to reduce your overall loan amount. It also means you can set a realistic budget based on your preferred terms and repayments.

We recommend jotting down the results generated by the calculator as you go as the device does not store the calculations for you.

Get repayment estimates quickly and easily whenever needed. Whether you’re online browsing the second-hand market or visiting a caravan show – our device is available anywhere and at any time.

With our online caravan loan calculator, the power of fast and reliable repayment estimates is in your hands. Make informed decisions on the spot and grab hold of great caravan deals. Estimate your repayments today and take control of the purchase process!

Convert Caravan Prices to Monthly Loan Repayments

Knowing what your monthly financial commitment will be for a new or used caravan is invaluable information. It only takes a few seconds and can give you a sense of the price range you should be looking at. Make sure your loan payments match what you can comfortably afford by using our online RV loan calculator.

Just enter the vehicle price, our advertised rate for your selected loan type, and your preferred repayment term into the relevant fields. You’ll instantly be provided with the monthly payment amount for that combination. If you are making a deposit, make sure you subtract that amount from the purchase price prior to entering the loan amount.

Our calculator can be used as many times as you like for as many caravans as you’re considering. Save time by pinpointing the right price range for your financial situation from the start, then reach out to us for an accurate quote and to start the application process.

Compare All RV Makes and Models

Easily estimate your loan repayments for all makes and models of caravan, new or used. Whether you’re in the market for a traditional caravan, camper trailer, campervan, toy hauler, motorhome, off-road vehicle, expedition rig, hybrid, budget friendly model, or custom-built van – our expert team of brokers have you covered.

Our full portfolio of loan products are available across all types of caravan so you can compare with ease. This means you can compare a camper with a caravan, a fully off-road vehicle with a hybrid, or an entry-level model with a top-of-the-line version.

With our highly competitive interest rates, you’ll be surprised at just how affordable your dream caravan could be. Enter your ideal figures in the calculator as a starting point and find a workable solution today!

Select a Repayment Schedule

When selecting a loan, you must carefully consider the term. That is, the length of time (in months or years) it will take you to repay it. Generally, a loan term will come down to your own personal preference, however, the lender will also need to approve it.

Determine whether a shorter, medium or longer term loan will work best for you and calculate repayment estimates based on that. To experiment with different loan terms and see how they affect your monthly payments, keep the loan amount and interest rate the same while solely adjusting the term.

Work out the loan structure that fits your financial goals and feel confident when applying.

Weigh Up Your Loan Options

When you use our caravan loan calculator, you have complete control over the figures you enter. This means you can experiment with as many different loan amounts and terms as you like to explore all your potential options. Such flexibility is very useful when figuring out how much you may want to deposit to reduce your overall loan amount. It also means you can set a realistic budget based on your preferred terms and repayments.

We recommend jotting down the results generated by the calculator as you go as the device does not store the calculations for you.

Access the Calculator Anywhere, at Anytime

Get repayment estimates quickly and easily whenever needed. Whether you’re online browsing the second-hand market or visiting a caravan show – our device is available anywhere and at any time.

With our online caravan loan calculator, the power of fast and reliable repayment estimates is in your hands. Make informed decisions on the spot and grab hold of great caravan deals. Estimate your repayments today and take control of the purchase process!

Take Control of the Purchase Process with the RV Finance Calculator

- Choose an RV suitable to your budget with fast price to payment calculations.

- Determine the repayment schedule that works for your financial goals.

- Plan your loan preferences and structure prior to application.

- Compare interest rates quickly for the best deal.

- Prepare early, set a budget, stick to budget.

Get Valuable RV Financing Estimates in a Few Simple Steps

Getting highly accurate caravan loan estimates is as easy as 1-2-3 with our quick, simple and efficient online calculation tool. Just enter the loan amount, interest rate, and your preferred term, and the device will do the rest. Your monthly repayment estimate will be generated based on the figures you have entered.

If you want to check another caravan, just enter a new loan amount. You can also consider different repayment schedules and interest rates by varying those details to match offers from another lender.

Buying for business purposes? You can choose to include a balloon payment for Chattel Mortgage and Commercial Hire Purchase credit facilities.

Repeat the process as many times as you like. Adjust details to include deposits, accessories, different loan terms, different models and more to fine tune your decision. When you’ve found a loan structure that matches your budget and preferences, request a firmed up, tailored quote.

Get started with Easy today!

- Quick and easy 3-step process.

- Use the device as many times as you like.

- No cost or obligation - compare vehicles, rates and terms.

Buy & Apply with Confidence - Easy’s Online RV Finance Calculator and Simple Application Process

When you’ve found the right caravan loan structure for your financial preferences, our team of experts will guide you through the steps of the application process. You’ll receive a quick quote from the most suitable lender for your financial situation who will offer you the best available interest rates based on your estimates.

Applying with Easy is smooth and streamlined. We provide support online and over the phone to ensure you know exactly what’s happening every step of the way. To start the process, upload your details and your assigned broker will assist you through the necessary paperwork. Let us handle all lender negotiation and manage the entire application process for you.

We also assist with settlement so you can get on the road in your new or second-hand recreation or commercial caravan faster, and with the most affordable repayments possible.

If you’re ready to make it happen, request a quick quote online today or give our expert team of brokers a call.

The Most Frequently Asked Questions

How does the Caravan Loan Calculator work?

Using our online loan calculator is simple! Enter the loan amount, interest rate, and preferred term, and you’ll instantly receive an estimated monthly repayment. You can compare different loan options by using the calculator, whether you’re interested in a personal caravan or a business one. The calculator is a great way to see what caravan will fit your budget without having to do any complicated maths.

Can I use the calculator to compare different types of caravans?

Yes – whether you want a traditional caravan, camper trailer, motorhome, toy hauler, a custom-built van, or another type, our online finance calculator can compare them all. Just enter the details and you’ll be able to clearly see how each option fits your financial situation.

What types of loan products can I select when using the RV finance calculator?

Our online calculator is versatile and can be used to estimate repayments for all caravan types and credit facilities. Secured and Unsecured personal caravan loans can be compared, as well as business credit facilities like Chattel Mortgage, Rent-to-Own, Commercial Hire Purchase, and Leasing. Our calculator exists to give you options, so start comparing and find the best deal for your needs.

How do I compare interest rates on the caravan loan calculator?

By entering the loan amount, interest rates, and repayment term, you’ll receive an instant monthly repayment estimate. To compare rates via the calculator, just vary the interest rate value you have entered. By doing this, you can see how each rate impacts your repayments. Choose the one that works best for your budget.

Is the caravan finance calculator free to use?

Our online caravan loan calculator is completely free. You do not require a subscription or need to pay any extra fees to use the device. Use it as many times as you need to – compare different loan amounts, terms and vehicles completely free of charge and with 0 obligation.

Am I able to adjust the loan term on the calculator?

Yes – our calculator allows you to experiment with different loan terms to see how they affect your repayments. Keep the loan amount and interest rate the same and just change the term to see how the repayments vary.

How do I factor in a deposit when using the online caravan loan calculator?

If you’re making a deposit on your caravan purchase, subtract the deposit amount from the total price prior to entering the loan amount into the calculator. By doing this, your loan amount will be more accurate and the repayment estimate will reflect what you will actually be borrowing.

Can I use the calculator for business caravan loans?

Yep – If you’re buying a caravan for commercial purposes, you can use the calculator to estimate repayments for all credit facilities including Chattel Mortgage, Leasing, Rent-to-Own, and Commercial hire Purchase. Our calculator exists to help business and personal buyers, so feel free to explore all the different loan types to find a solution that works for your needs.

What device do I need to have to access the online caravan loan calculator?

Our calculator works on any device with an internet connection. Browse caravans online, at a show, or at a dealership – you can get instant estimates while you shop. Make quick, informed decisions wherever you are.

What happens after I receive a repayment estimate I am happy with?

After receiving a repayment estimate that you are satisfied with, reach out to our expert team of brokers for a tailored quote specific to your financial situation. We will assist you through the entire process and help you find the best lender and most competitive rates possible. We also handle all the paperwork and settlement, ensuring you’re on your way to owning your caravan as soon as possible.

Let Easy Caravan Finance simplify the process by taking care of the complicated steps for you